boulder co sales tax return form

Penaltiesinterest will apply if taxes are incorrectly remitted so please timely note tax rate changes and utilize the city tax return found through the Boulder Online. Web Use tax must be paid by City of Boulder businesses and individuals for purchases brought into City Limits that did not include City of Boulder sales tax or when inventory acquired.

Colorado Springs Sales Tax Fill Online Printable Fillable Blank Pdffiller

If you need additional assistance please call 303-441-3050 or e.

. 025 sales tax through 2009. Web Reconciliation is a process of filing a construction use tax return upon completion of a permitted construction project to determine whether there was an overpayment or. After you create your own User ID and Password for the income tax account you may file a return through.

Sales tax returns must be filed monthly. Web 300 or more per month. BOX 791 BOULDER CO 80306 303441- 3288.

Monthly returns are due the 20th day of month following reporting period. Web Boulder CO Sales Tax Rate. The Customer Contact Center which can be.

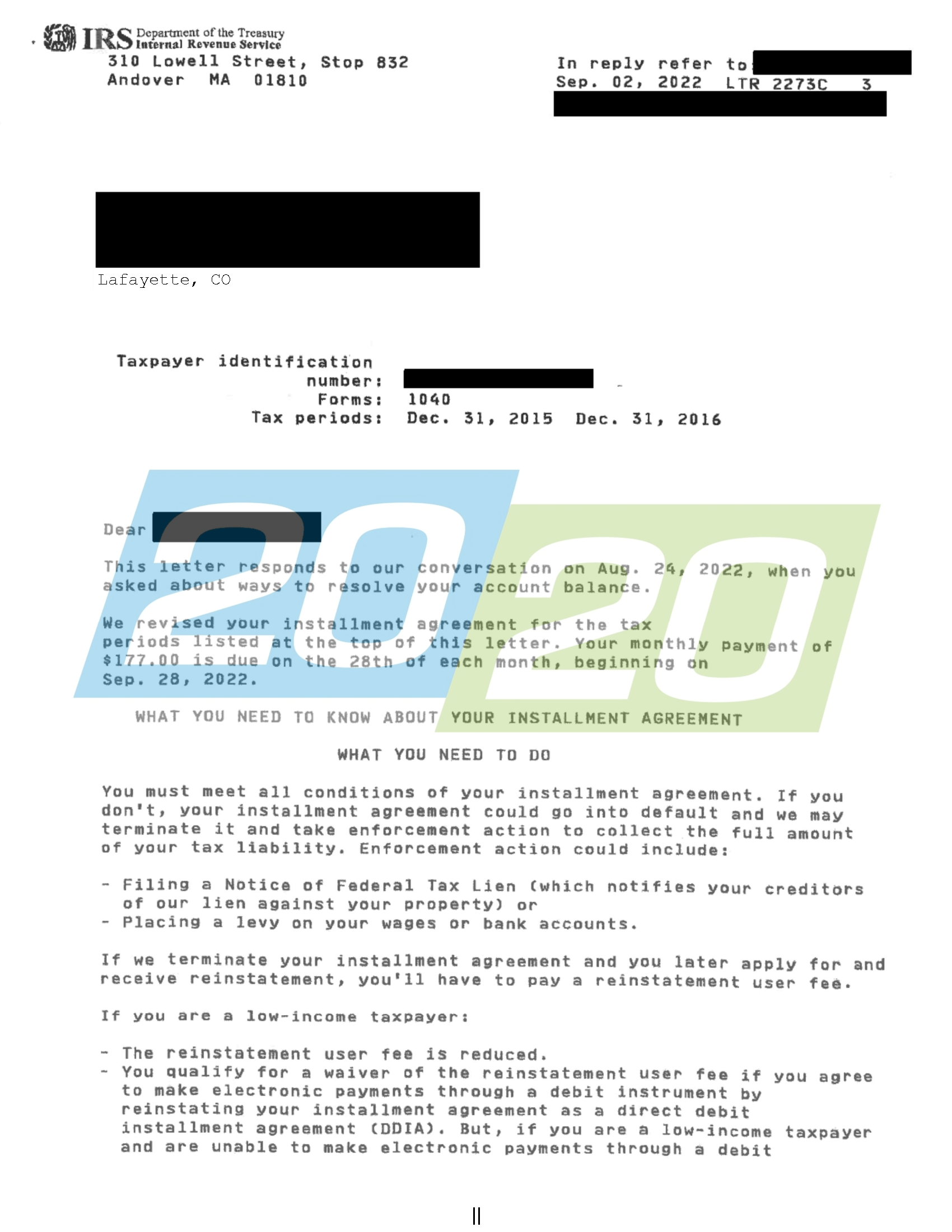

This includes sales made to students faculty and staff not. Web The combined countywide open space sales and use tax is 06 and is the result of the following voter-approved sales tax resolutions. Internal Revenue Service 1999 Broadway Denver MF 830 am430 pm 303-446-1675 for appointment 844-545-5640 Full-service walk-in office with all forms.

Web A briefing describing the tax lien sale process will be held for interested investors prior to the sale. This briefing is for information only and attendance is not. Web When the university sells tangible property to non-university non-tax-exempt entities the sale is subject to sales tax.

Web DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. Web Construction companies engaged in business in the City of Boulder in the capacity of a seller or user of tangible property and taxable services must obtain a sales and use tax. Web Subcontractor Affidavit Page 2 1777 BROADWAY PO.

Businesses that pay more than 75000. Web Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020. Web Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides.

Sales tax is due on all retail. Web Boulder City Hospital Foundation. The current total local sales tax rate in Boulder CO is 4985.

Web There are a few ways to e-file sales tax returns. The December 2020 total local sales tax rate was 8845. Web Colorado Sales Tax Guide Tax Filing DR 0800Sales tax classes and videos available online at TaxColoradogoveducation.

DR 0154 - Sales Tax Return for Occasional Sales.

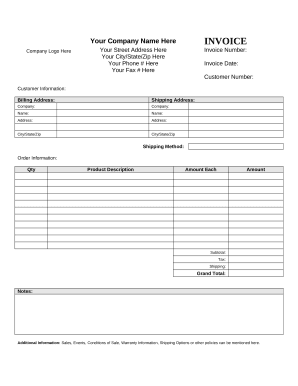

City Of Boulder Sales Tax Form Fill Out Sign Online Dochub

Frequently Asked Questions Boulder Library Ballot Issue 6c

Know Your Voting Rights Boulder County

Housing Human Services Boulder County

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing

Co Sales Tax Return City Of Boulder Fill Out Tax Template Online

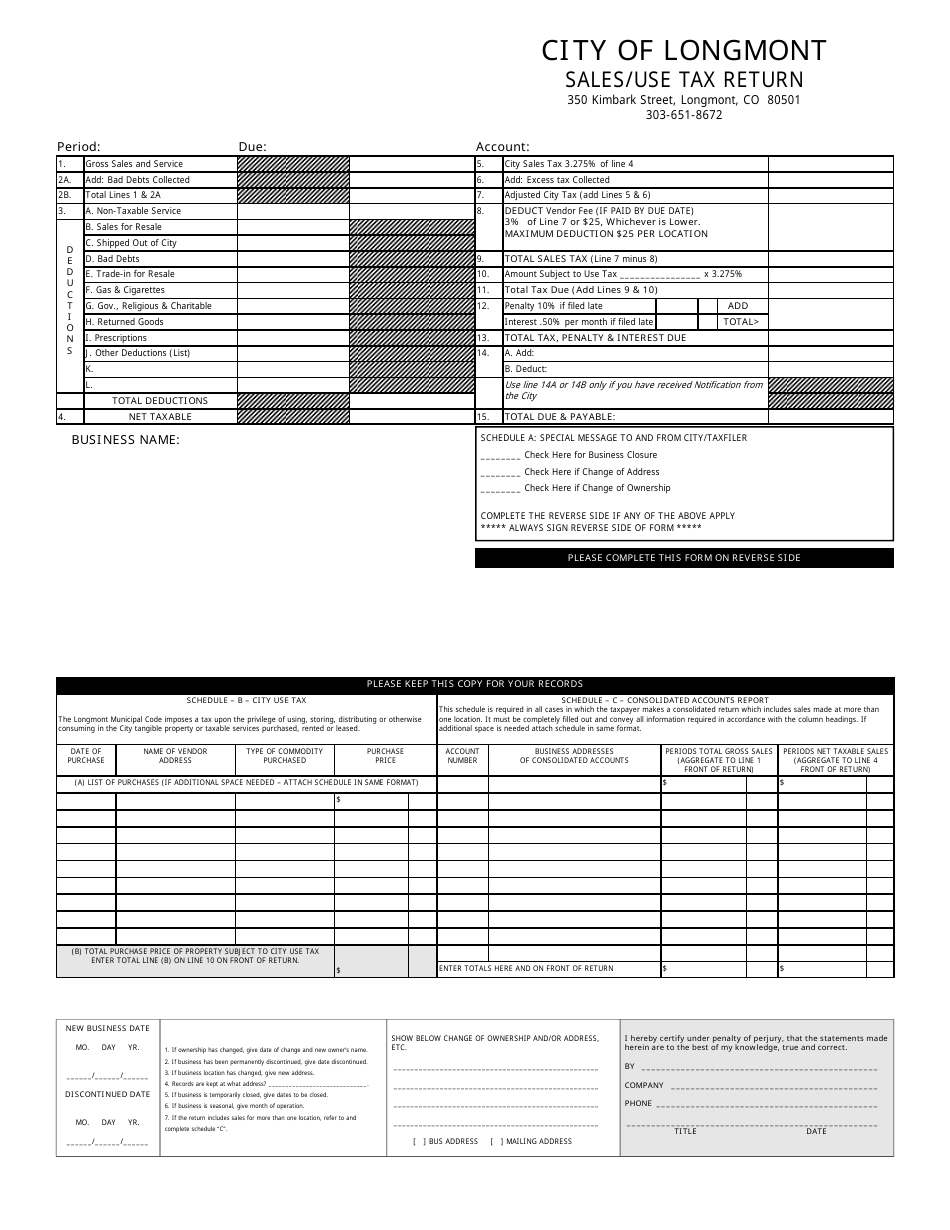

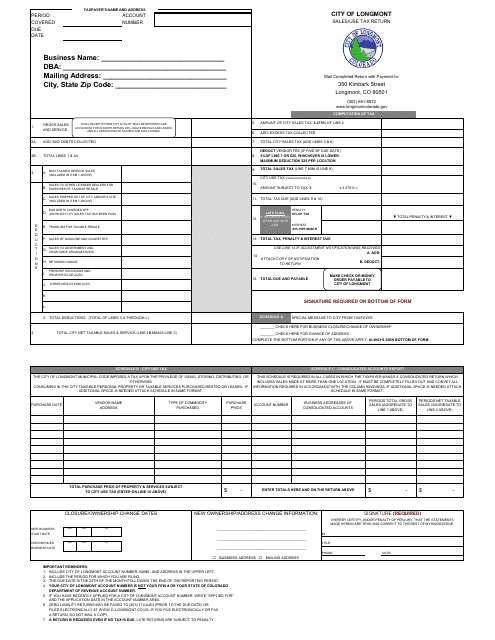

Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Nevada Sales Tax Guide For Businesses

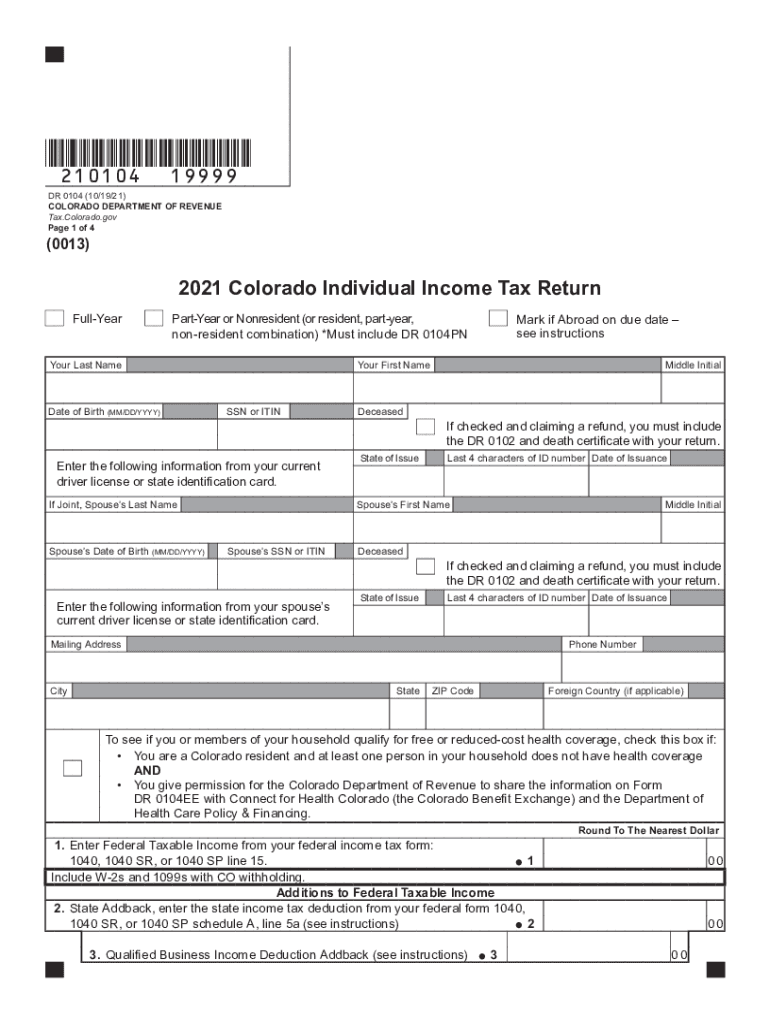

104 Colorado Department Fill Out Sign Online Dochub

Boulder County Hazard Mitigation Plan News Town Of Superior Colorado

Cancer Hates Tea A Unique Preventive And Transformative Lifestyle Change To Help Crush Cancer Uspenski Maria Hardy Dr Mary L 9781624143120 Amazon Com Books

Tax Resolutions In Colorado 20 20 Tax Resolution

An Essential Guide To Voting In Boulder County The Bold Cu

Managing Remotely Boulder County Firms See Challenges For Hr Accounting While Allowing Remote Work

Sam Auctions Auction Catalog Liquor Mart Boulder Co Feb 4th 2020 Online Auctions Proxibid

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Boulder Colorado Is The Happiest City In The United States 2017